I care about the environment, so I care about transportation, so I care about EVs (or better yet, not carting your sorry ass and a laptop and/or a few kilos of groceries around in a 2-ton manufactured product), so I care about new car companies that might move us off fossil fuels. But a lot of those car companies have turned into outright stock scams preying on clueless investors hoping to make a fortune on “the next Tesla.” Some day I’ll blog about Faraday Future’s doorless race car debacle, Canoo re-wrapping the same handful of prototypes with different potential customer’s logos, and Nikola (not-Tesla) Motors’ 600-station hydrogen trucking fantasy (update: I did, read “cars: more EV fiascos at Faraday, Nikola, and Canoo“).

Enter Mullen

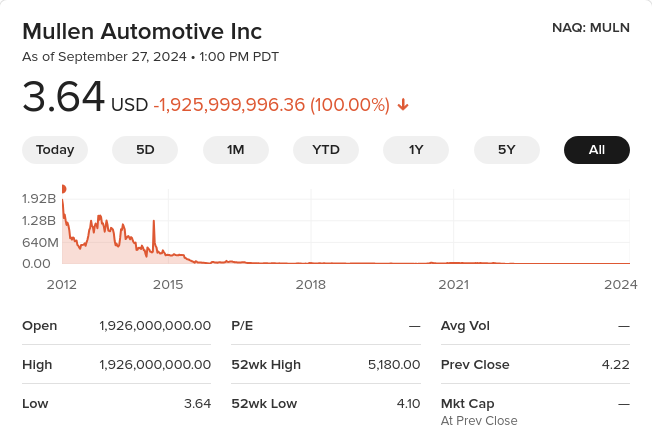

These EV companies circling the drain pale next to Mullen Automotive, the most extreme and audacious con going. Here is the stock price history for $MULN. It is bat-sh*t insane!

Don’t glaze over! Look at the line starting 3.64 USD. That says the price of one share of Mullen today is $3.64. Then in red, it says that one share has dropped in price from $1.926 billion dollars (for one share!!), a loss of 100%.

The chicanery of reverse stock splits

Except one single share of this junk EV wannabe maker was obviously never worth $2 billion dollars. To remain listed on a “reputable” exchange like the NASDAQ, your stock has to trade for more than a dollar, otherwise it’s a penny stock. So Mullen repeatedly has reverse stock splits. This isn’t Nvidia saying “Our stock price has risen a lot but we want one share to cost around $200, so we’ll turn each share you own into 10 shares; you’re welcome” and after this 10→1 stock split the price of one Nvidia share drops to 1/10 what it was. Instead Mullen says “You thought you owned 500 shares in us each only worth pennies, but ha-ha sucker, now you only own 20 shares” so in theory after this 25→1 reverse stock split each share is worth 25 times more and the share price briefly rises to a few dollars before continuing its decline. Both kinds of stock splits don’t change the size of the slice of the company that you own, but one direction hides the fact that you’re holding a slice of a s**t sandwich.

Printing money shares soon to be worthless

Mullen has done this six times (100 shares→1, 100 shares→1, 9 shares→1, 25 shares→1, 10 shares→1, and the original 10 shares →1 back in 2016). As financial sites like CompaniesMarketCap point out (caution: they get confused and run out of digits), “One MULN share bought prior to May 25th, 2016 would equal to 4.4444444444444E-9 MULN shares today” One share shrank to 4 billionths of a share. But in between these reverse splits over and over to keep its stock price up, Mullen also issues millions of new shares to pay its corrupt CEO David Michery money and pay a few bills. Insanely, enough investors fall for this that the scam has continued for 10 years.

Ignoring the stock price graph, how is Mullen Automotive doing? In its financial results for the quarter ending June 2024 it reported that it only has $4M cash in the bank, only made a measly $65,000 in revenue, unsurprisingly lost $91M on that pathetic revenue, yet it paid its CEO $47M in 2023. It keeps cranking out press releases touting orders for its EVs coming in from around the world and new dealers and overseas partners… and it’s all fake. In three months it got paid for one imported Chinese EV van.

spage’s law #4 and Elon Musk’s wisdom

People somehow get caught up in magical thinking. “I like the prototype, as do lots of other people, the company says they have thousands of orders/reservations/letters of intent… just make the cars and the money will roll in.” So why doesn’t Mullen actually make and sell some electric vehicles?

You can let Elon Musk explain it. He’s said and tweeted: “Prototypes are easy, production is hard”, also “Production with positive cash flow is extremely hard.” But people refuse to grasp the import of the latter seven words. As I’ve started posting when people gush over some cool prototype from a struggling EV maker,

spage’s law: EV startups can lose $millions a month promising to enter volume production “soon,” or they can actually start cranking out vehicles and immediately lose $100M+ a quarter.

Aptera, Canoo, Einride, ElectraMeccanica, Faraday Future, Mullen (total scammers), Nikola (back to promising HFC production after the battery Tre fiasco), Phoenix Motors, REE, XOS, etc. are all in this zombie state. Lucid and Rivian exited it, but they had $billions in cash. Fisker tried to avoid it by paying Magna to build cars but that didn’t work. RIP Arcimoto, Arrival, Bollinger, Coda (I have a long memory!), Electric Last Mile Solutions, Lightning eMotors, Lightyear, Lordstown Motors, Proterra, Smith Electric, Sono, Volta, Workhorse Group, etc.; all bankrupt or have abandoned electric vehicle manufacturing, and of those I think only Proterra and Smith Electric manufactured hundreds of vehicles.

That “lose $100M” is real cold hard cash, not sequences of numbers in a financial report. You need to actually pay suppliers for the parts, and factory workers to screw them together into a vehicle, and someone to ship the vehicles to customers. If you don’t have cash to write those checks, you go bust. End of story. Yet company fans and the remaining abused stockholders continue to believe these zombie companies will sprout wings and fly: any day now they’ll put thousands of compelling vehicles into the hands of happy customers and start chasing Tesla, or at least Rivian. Nope. Not gonna happen!

Rubber-necking at a train wreck

The Tragic Downfall of Mullen Automotive is a grimly entertaining video from serial doubter Wall $treet Millennial on this ridiculous company. A plastic fake Ferrari, an ex-felon hawking a magic box with wires poking out that “increases range 60%!”, repeated failures to ever ship a car then getting sued by the latest Chinese partner that was going to build them, etc. It’s easy to laugh. But real people really did invest tens or hundreds of thousands of dollars into the company because they liked the idea of EVs, and now have one share worth less than a Big Mac.

Edit 3: Mullen Automotive: The Reverse Split King’s Stunning Ability to Stay Alive from Financhle (?) focuses on $MULN’s crazy stock issues, dilution, and reverse stock splits.

Edit: Top Ships lost a trillion quadrillion dollars per share

Apparently this insanity isn’t limited to wannabe EV companies. One share in Top Ships, “an international owner and operator of tanker vessels,” has “lost” $500 trillion since inception, and was briefly “worth” $1 quadrillion per share compared with its current stock price of $9.05. Spoiler: the entire company was never worth even a millionth of that much money, let alone a single share. Top Ships had so many reverse stock splits in 2017 they overlap on every historical graph that shows them.

CompaniesMarketCap has a table of its stock splits. If you had one share of Top Ships at the start of March 2008, you would theoretically have 22 quadrillionths of a share now. If your holding in $TOPS back then was equivalent to a kilogram of beef, you would own much less than a single muscle cell now. But the company survives and has even made a profit in two of the last 15 years.

| Date | Split | Multiple | Cumulative multiple |

|---|---|---|---|

| 2023-09-29 | 1:12 | x0.083333333333333 | x2.2045855379189E-14 |

| 2022-09-23 | 1:20 | x0.05 | x2.6455026455026E-13 |

| 2020-08-10 | 1:25 | x0.04 | x5.2910052910053E-12 |

| 2019-08-22 | 1:20 | x0.05 | x1.3227513227513E-10 |

| 2018-03-26 | 1:10 | x0.1 | x2.6455026455026E-9 |

| 2017-10-06 | 1:2 | x0.5 | x2.6455026455026E-8 |

| 2017-08-03 | 1:30 | x0.033333333333333 | x5.2910052910053E-8 |

| 2017-06-23 | 1:15 | x0.066666666666667 | x1.5873015873016E-6 |

| 2017-05-11 | 1:20 | x0.05 | x2.3809523809524E-5 |

| 2016-02-22 | 1:10 | x0.1 | x0.00047619047619048 |

| 2014-04-21 | 1:7 | x0.14285714285714 | x0.0047619047619048 |

| 2011-06-24 | 1:10 | x0.1 | x0.033333333333333 |

| 2008-03-20 | 1:3 | x0.33333333333333 | x0.33333333333333 |

Edit #2: apparently $CEI/CEIN is another crazy stock.

Edit #3: Mullen has had two more reverse stock splits in 2025! 1 for 60 shares and 1 for 100 shares. “If you bought 1,350,000,000,000 shares of MULN before May 24, 2016, you’d have 1 share today.” But of course Mullen never had that many shares, it keeps issuing new shares, diluting the value of each one. The current number of shares outstanding is 2.4 million; someone on Reddit explains this as “Take the original market cap of the company and divide it by 32.4 quadrillion and that’s how much the OG investor shares are worth.”